estate tax changes build back better

Most of the major proposals that would create substantial changes in the estate planning arena were not included. 3 version introduced an increase to the cap with a slightly higher increase in the Nov.

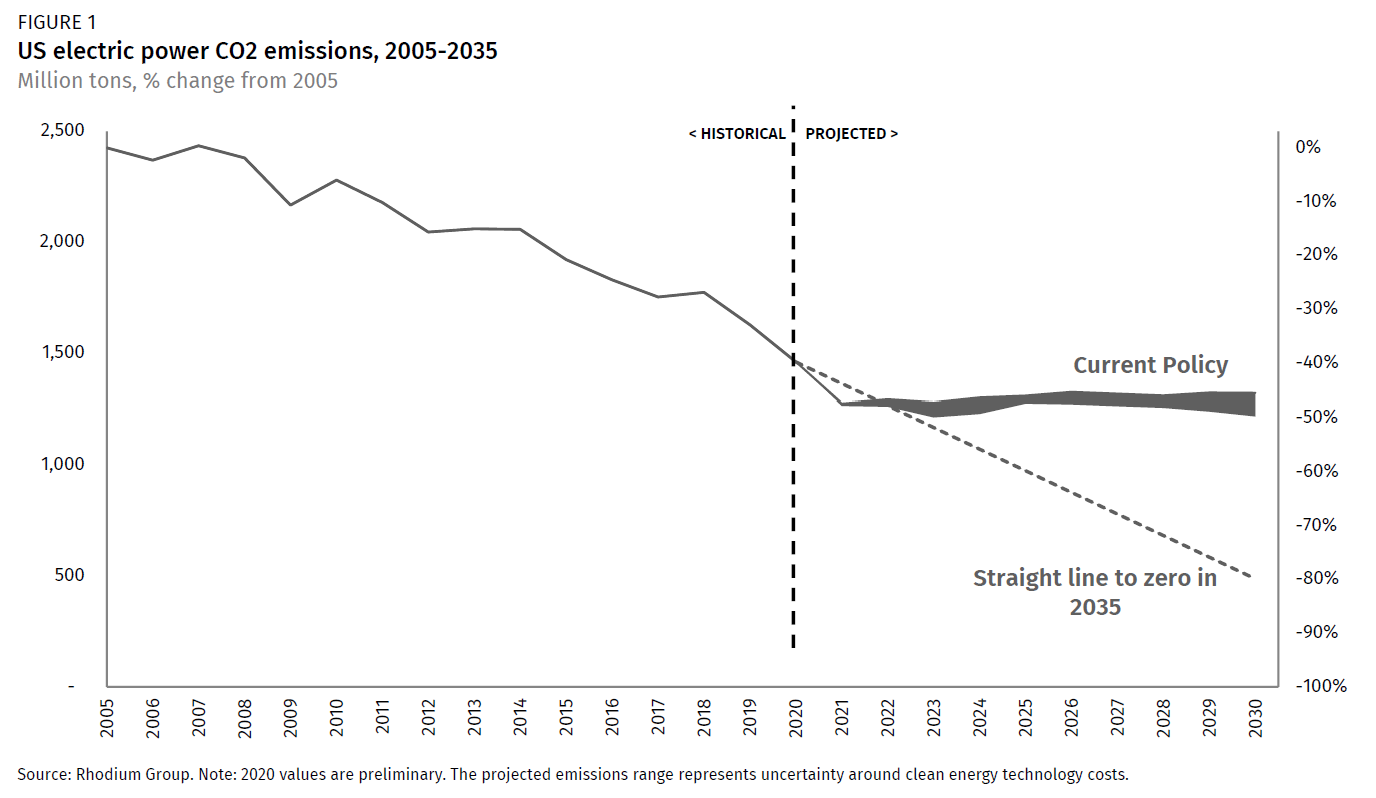

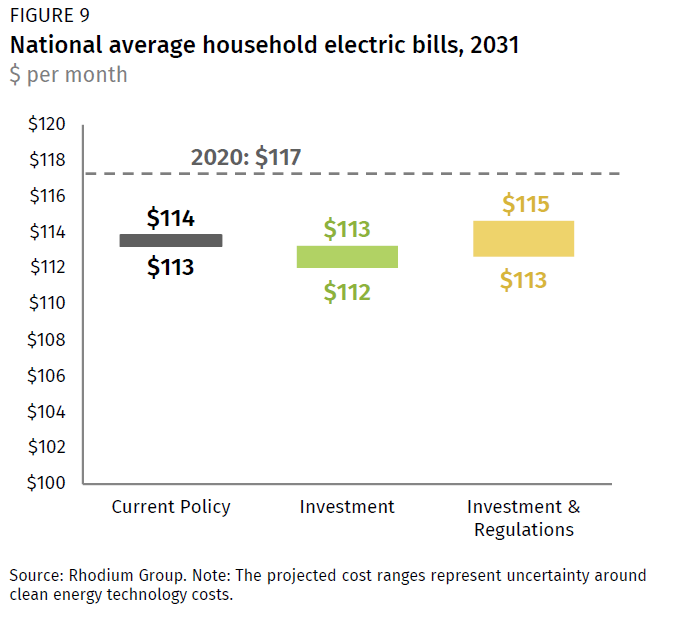

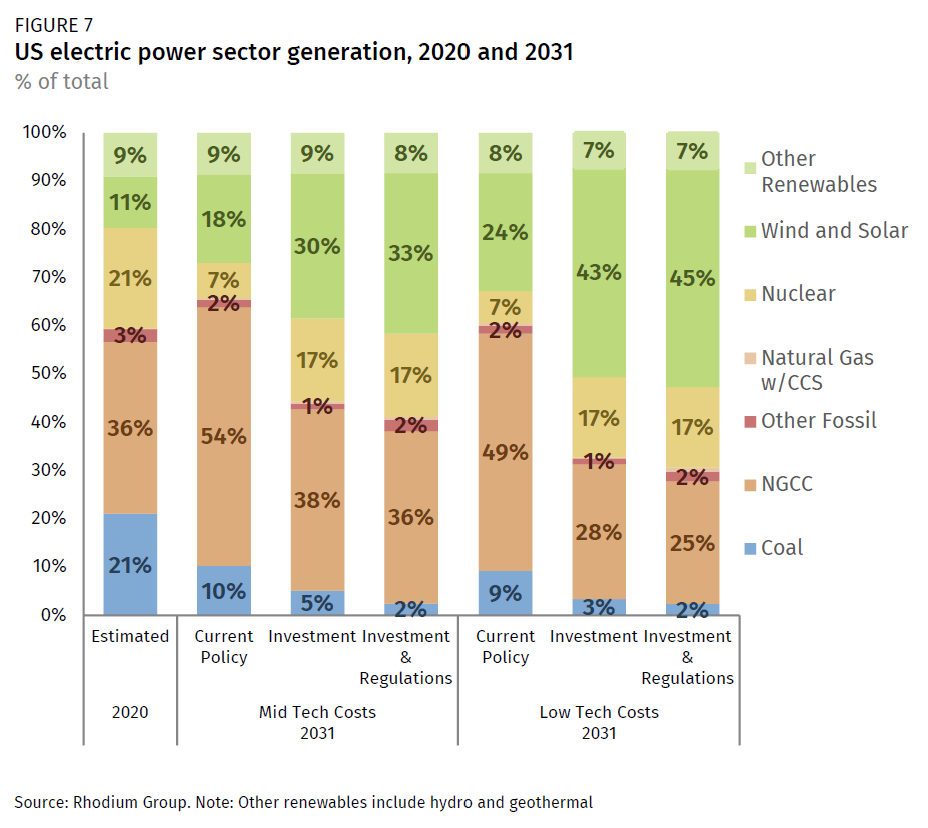

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

115-97 increase the limits on certain discounts of value for.

. This means that an individual can leave 1206 million and a married couple can leave 2412 million dollars to their heirs or beneficiaries without paying. Various senators support some proposals eg estate and gift changes and the Billionaires Income Tax that are not in the current bill. Restaurants In Erie County Lawsuit.

One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021. On September 13 2021 the House Ways and Means Committee released a proposed tax bill House proposal as part of the Biden administrations Build Back Better Act The segments of the proposed bill discussed below highlight important changes to the way trusts estates and individuals could be taxed. The CBO estimates the bill will cost almost 17 trillion and add 367 billion to the federal deficit over 10 years.

Lowering the gift and estate tax exemptions seems a lock. Now Step 2 may not have to. Are Dental Implants Tax Deductible In Ireland.

Estate and gift tax exemption. Revised Build Back Better Bill Excludes Major Estate Tax Proposals. December 6 2021.

Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in the House of Representatives. Restaurants In Matthews Nc That Deliver. Under current law the existing 10 million exemption would revert back to the 5 million exemption.

That was Step 1. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. 5376 would revise the estate and gift tax and treatment of trusts.

Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA. These proposals are currently under consideration by the U. As initially proposed the Act would have reduced the current 117 million basic exclusion amount BEA to approximately 6 million on January 1.

Proposed Reduction in Federal Estate Tax Exemption Amount. As the draft stands the legislative proposal could restrict the abilities of higher net worth individuals to. The provisions effective date is January 1 2022 and the expectation is the law will not seek to apply retroactively to gifts made in 2021.

However it is important to note that this proposed legislation is. Opry Mills Breakfast Restaurants. 28 2021 President Joe Biden announced a framework for changes to the US.

In its then-current form the legislation would have had drastic impacts on transfer taxes grantor trust rules and income taxes. Economic Effects of the Updated House Build Back Better Act For purposes of estimating the bills impact on federal budget deficits interest payments and resulting changes in GNP we have estimated about 213 trillion of net outlays over the period 2022-2031 inclusive of scored tax credits. Adding in 207 billion of nonscored revenue that is estimated to result from increased tax enforcement in the bill the net total increase to the deficit would be 160 billion.

Lowering the gift and estate tax exemptions seems a lock. Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan. The proposal reduces the exemption from estate and gift taxes from 10000000.

The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation. The exclusion amount is for 2022 is 1206 million. The proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Majestic Life Church Service Times. Estate Tax Changes Build Back Better.

The federal estate tax exemption is currently set at 10 million and is indexed for inflation. The bill contains a wide variety of tax provisions. Our tax expert weighs in.

Larson Brown PA. Under current law the existing 10 million exemption would revert. The House Ways and Means Committee approving the tax provisions in President Bidens Build Back Better Act BBBA marks a significant first step towards the bills passage.

Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov. However this current proposal would accelerate. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation.

The final version of the Build Back Better Act will likely remain a moving target for at least the next month. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. The provisions effective date is January 1 2022 and the expectation is the law will not seek to apply retroactively to gifts made in 2021.

For decedents dying in 2021 this amount is 117 million. Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the. So if the bill changes almost anything could be back on the table.

Instead it contains three primary changes affecting estate and gift taxes. Step 2 would be to forgive the note immediately before passage of an estate tax exemption balance reduction or whenever the donor was ready to do so. Income Tax Rate.

Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law. In late October the House Rules Committee released a revised version of the proposed Build Back Better Act Reconciliation Bill. It would eliminate the temporary increase in exemptions enacted in the Tax Cuts and Jobs Act TCJA.

The estate tax exemption was scheduled to revert to 50 million on January 1 2026.

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

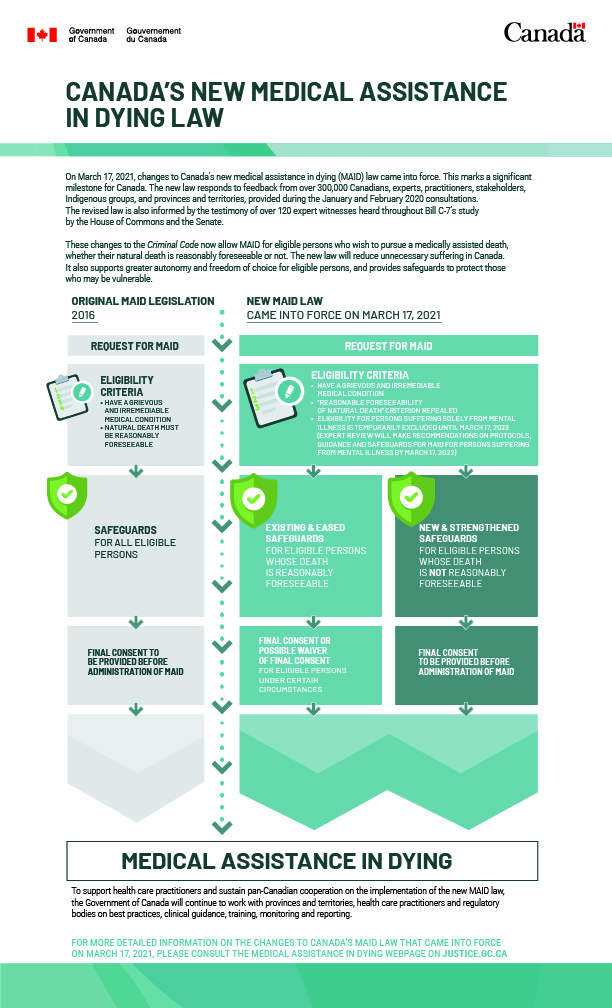

Canada S New Medical Assistance In Dying Maid Law

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Pathways To Build Back Better Investing In 100 Clean Electricity Rhodium Group

Time To Change Your Estate Plan Again

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Measuring What Matters Toward A Quality Of Life Strategy For Canada Canada Ca

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

Billionaire S Association With Luxury B C Mansion Highlights Property Tax Loophole Cbc News

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Building Back Together Buildingback Us Twitter

Tax Measures Supplementary Information Budget 2022

Managing Your Personal Taxes 2021 22 A Canadian Perspective Ey Canada